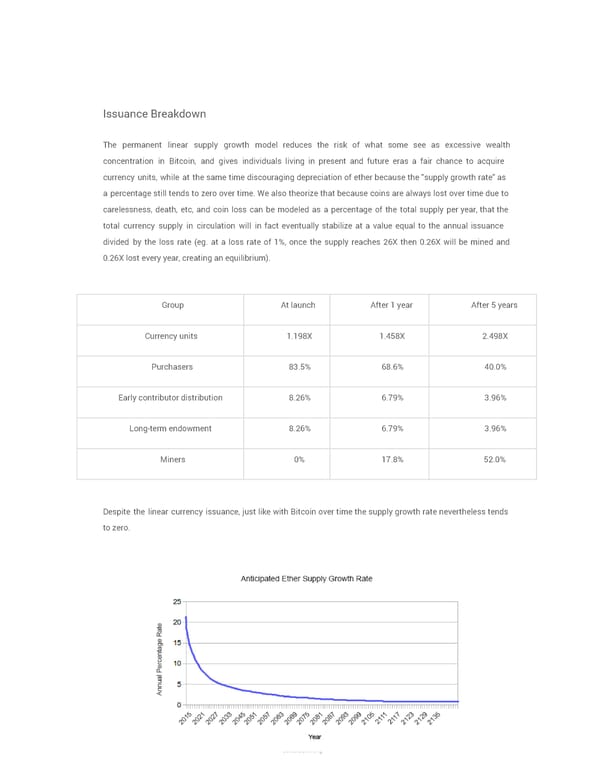

Issuance Breakdown The permanent linear supply growth model reduces the risk of what some see as excessive wealth concentration in Bitcoin, and gives individuals living in present and future eras a fair chance to acquire currency units, while at the same time discouraging depreciation of ether because the "supply growth rate" as a percentage still tends to zero over time. We also theorize that because coins are always lost over time due to carelessness, death, etc, and coin loss can be modeled as a percentage of the total supply per year, that the total currency supply in circulation will in fact eventually stabilize at a value equal to the annual issuance divided by the loss rate (eg. at a loss rate of 1%, once the supply reaches 26X then 0.26X will be mined and 0.26X lost every year, creating an equilibrium). Group At launch After 1 year After 5 years Currency units 1.198X 1.458X 2.498X Purchasers 83.5% 68.6% 40.0% Early contributor distribution 8.26% 6.79% 3.96% Long-term endowment 8.26% 6.79% 3.96% Miners 0% 17.8% 52.0% Despite the linear currency issuance, just like with Bitcoin over time the supply growth rate nevertheless tends to zero. Page 31 ethereum.org

Ethereum White Paper by Vitalik Buterin Page 34 Page 36

Ethereum White Paper by Vitalik Buterin Page 34 Page 36