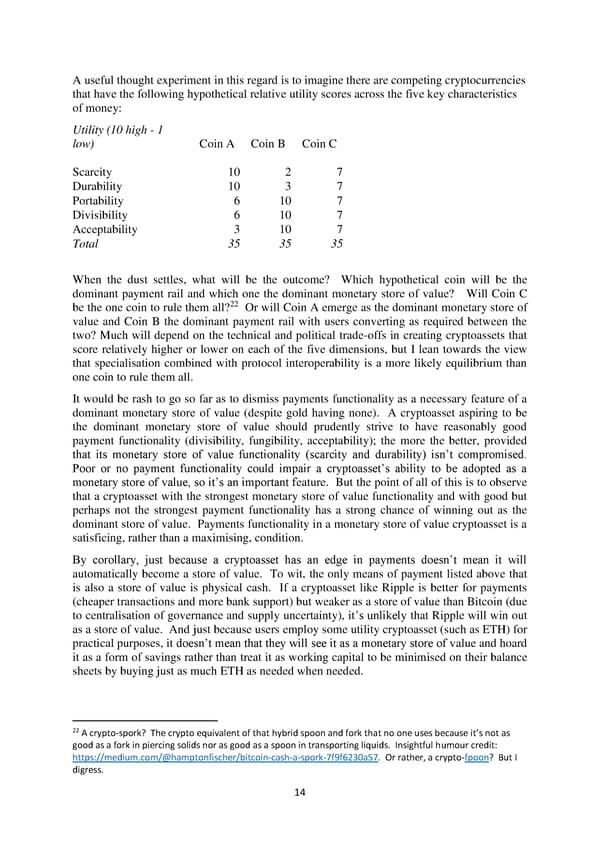

A useful thought experiment in this regard is to imagine there are competing cryptocurrencies that have the following hypothetical relative utility scores across the five key characteristics of money: Utility (10 high - 1 low) Coin A Coin B Coin C Scarcity 10 2 7 Durability 10 3 7 Portability 6 10 7 Divisibility 6 10 7 Acceptability 3 10 7 Total 35 35 35 When the dust settles, what will be the outcome? Which hypothetical coin will be the dominant payment rail and which one the dominant monetary store of value? Will Coin C be the one coin to rule them all?22 Or will Coin A emerge as the dominant monetary store of value and Coin B the dominant payment rail with users converting as required between the two? Much will depend on the technical and political trade-offs in creating cryptoassets that score relatively higher or lower on each of the five dimensions, but I lean towards the view that specialisation combined with protocol interoperability is a more likely equilibrium than one coin to rule them all. It would be rash to go so far as to dismiss payments functionality as a necessary feature of a dominant monetary store of value (despite gold having none). A cryptoasset aspiring to be the dominant monetary store of value should prudently strive to have reasonably good payment functionality (divisibility, fungibility, acceptability); the more the better, provided that its monetary store of value functionality (scarcity and durability) isn’t compromised. Poor or no payment functionality could impair a cryptoasset’s ability to be adopted as a monetary store of value, so it’s an important feature. But the point of all of this is to observe that a cryptoasset with the strongest monetary store of value functionality and with good but perhaps not the strongest payment functionality has a strong chance of winning out as the dominant store of value. Payments functionality in a monetary store of value cryptoasset is a satisficing, rather than a maximising, condition. By corollary, just because a cryptoasset has an edge in payments doesn’t mean it will automatically become a store of value. To wit, the only means of payment listed above that is also a store of value is physical cash. If a cryptoasset like Ripple is better for payments (cheaper transactions and more bank support) but weaker as a store of value than Bitcoin (due to centralisation of governance and supply uncertainty), it’s unlikely that Ripple will win out as a store of value. And just because users employ some utility cryptoasset (such as ETH) for practical purposes, it doesn’t mean that they will see it as a monetary store of value and hoard it as a form of savings rather than treat it as working capital to be minimised on their balance sheets by buying just as much ETH as needed when needed. 22 A crypto-spork? The crypto equivalent of that hybrid spoon and fork that no one uses because it’s not as good as a fork in piercing solids nor as good as a spoon in transporting liquids. Insightful humour credit: https://medium.com/@hamptonfischer/bitcoin-cash-a-spork-7f9f6230a57. Or rather, a crypto-fpoon? But I digress. 14

Investor’s Take on Cryptoassets by John Pfeffer Page 13 Page 15

Investor’s Take on Cryptoassets by John Pfeffer Page 13 Page 15